What Corporate Tax Documents Do You Need to File a T2 Return? The Complete T2 Checklist

Do you dread the moment you have to file your corporate tax return? You’re not alone. Across Canada, thousands of entrepreneurs lose hours, and sometimes hundreds of dollars, looking for the right corporate tax documents at the last minute.

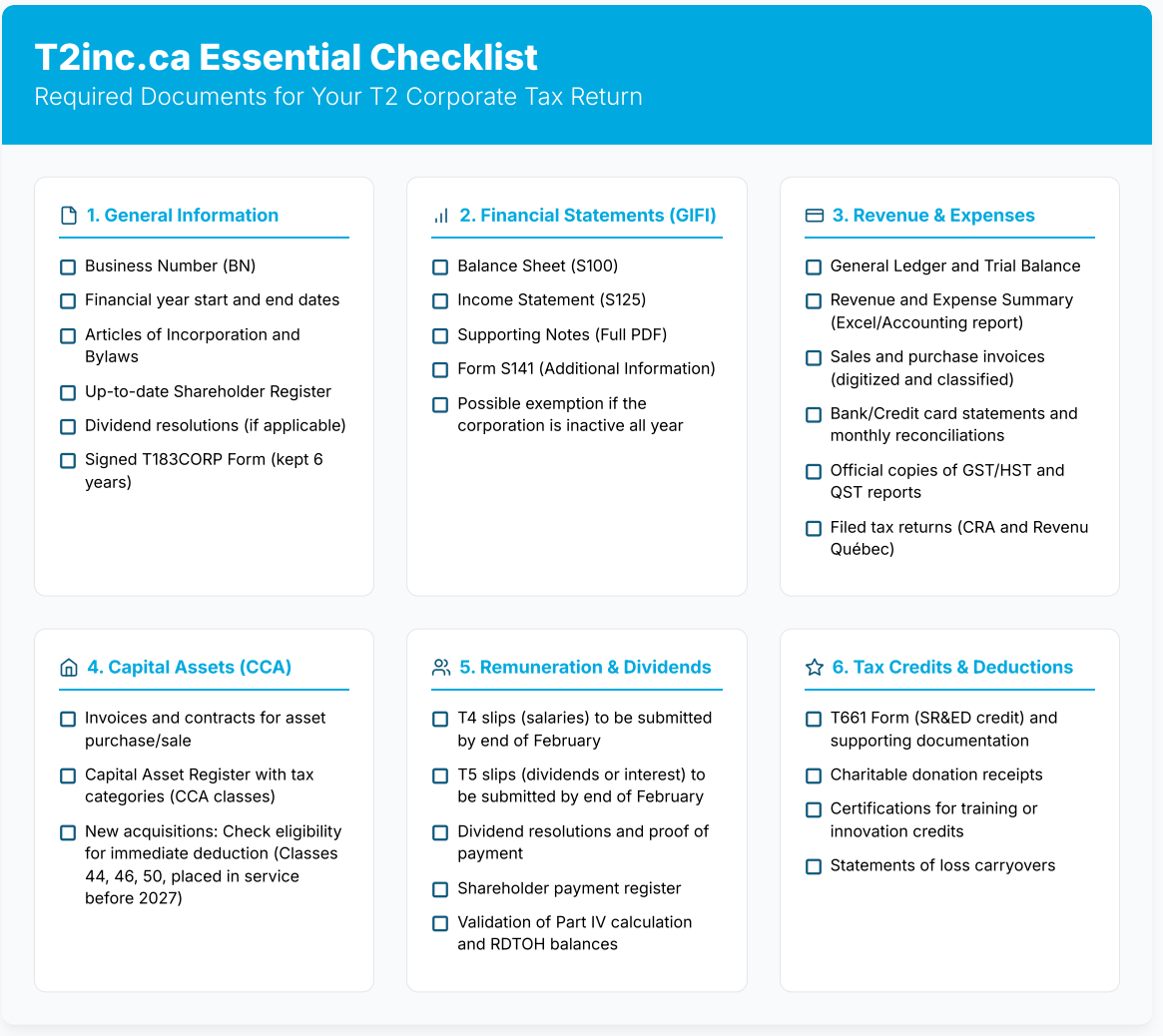

With the right T2 checklist, you can turn this stressful process into a simple, organized task. By gathering all the required documents for your T2 return, you’ll save time, reduce errors, and stay compliant with the Canada Revenue Agency (CRA).

This practical guide explains exactly what documents you need to prepare for your business tax return. You’ll find a full list of supporting items, financial statements, receipts, tax slips, and more, along with expert tips to help you stay organized and avoid penalties.

T2 Checklist: The Essentials

Why Preparing Your Corporate Tax Documents Early Matters

Filing your T2 tax return without collecting your paperwork is like leaving for a trip without packing your suitcase: you might get there eventually, but it will be long and messy. Preparing early helps you save time, reduce mistakes, and file with peace of mind.

Here’s why early preparation makes all the difference:

- Save time: Every missing document slows the process. Your accountant must pause, reach out, and wait for your response. Having everything ready accelerates your T2 preparation.

- Reduce errors: Every number in your tax form must be backed by proof. Missing invoices or incomplete bank statements can trigger audits and affect your accuracy.

- Avoid penalties: Many Canadian corporations file late because they can’t find all their paperwork. The CRA automatically applies late penalties, even if your taxes are correct.

- Optimize your taxes: A complete file helps identify deductible expenses, depreciable assets, and available tax credits such as R&D or training credits.

- Save money: Time spent hunting for receipts costs money. The better your records are, the faster and more affordable your T2 filing process will be.

Essential Business Tax Documents to Gather

Before you start filling out the form, let’s cover the basics. A successful T2 filing begins with complete and accurate company information.

You’ll need your business number (BN), fiscal year dates, and articles of incorporation. Also, make sure your shareholder register is up to date and that dividend resolutions, if any, are documented.

If you’re working with a corporate tax accountant, don’t forget to sign Form T183CORP, which authorizes the electronic transmission of your T2 return to the Canada Revenue Agency (CRA). Without this authorization, your return can’t be filed electronically.

Financial Statements: The Core of Your T2 Filing

Your financial statements are the foundation of your T2 return. They summarize your company’s financial performance and provide the data needed for tax calculations.

At a minimum, you’ll need:

- A balance sheet (Schedule 100)

- An income statement (Schedule 125)

- Notes to the financial statements

These are translated into GIFI codes (General Index of Financial Information), a standardized format required when you file your T2 return electronically using accounting software.

Balance Sheet (Assets, Liabilities, and Equity) - Schedule 100

The balance sheet shows your company’s financial position at the end of the year: what you own, what you owe, and your net equity.

It includes:

- Assets: cash, inventory, equipment, and real estate.

- Liabilities: debts, loans, accounts payable.

- Equity: shareholders’ capital and retained earnings.

Verify that short-term items like accounts receivable or wages payable are included. Missing these can distort taxable income and cause filing delays.

Income Statement (Revenue and Expenses) - Schedule 125

The income statement, also known as the profit and loss statement, summarizes your financial activity during the fiscal year.

It includes:

- Operating revenue: sales, fees, commissions, rental income.

- Operating expenses: salaries, rent, marketing, utilities, and supplies.

- Net income: the difference between revenues and expenses before taxes.

Common mistakes? Forgetting recurring expenses (like software subscriptions) or mixing personal and business purchases can both inflate your taxable income.

Additional Information - Schedule 141

This section gathers technical accounting details: method used, currency, and bookkeeping status. It’s essentially your company’s accounting profile.

Supporting Corporate Tax Documents: Proof and Reconciliation

A complete T2 return requires supporting documentation for every reported number. Keep everything that backs up your income, deductions, and taxes.

We recommend digitizing receipts and invoices throughout the year. It saves time, minimizes errors, and keeps you ready when tax season arrives.

General Ledger and Trial Balance

The general ledger and trial balance summarize every transaction. Most accounting systems (QuickBooks, Xero, Sage, Acomba) allow you to export them directly.

Your accountant may only need a summarized spreadsheet showing revenues and expenses, as long as all reconciliations and GST/HST filings are complete.

Sales and Purchase Invoices

Invoices are the backbone of your T2 return. They confirm your revenue and justify deductions. Ideally, store them digitally by fiscal year.

Many tools now automate this process by scanning and classifying documents. Keep business and personal expenses separate; mixing them complicates verification and can lead to denied deductions.

Bank Statements and Reconciliations

Bank statements verify account balances and help identify recording errors. Keep all statements, bank, credit card, and line of credit, in PDF format.

Perform monthly bank reconciliations to confirm that your books match your actual balances. This simple habit ensures accuracy and smooths out your corporate tax filing process.

Sales Tax Returns (GST/HST)

The CRA uses your GST/HST returns to confirm that reported sales and purchases align with your financial statements.

Before filing your T2, gather:

- GST/HST summaries filed during the year

- Reports of taxes collected and paid from your accounting software

- Copies of submitted returns from your CRA account

If you use software like QuickBooks or Acomba, make sure all tax periods are closed before completing your year-end.

Fixed Assets and Depreciation

If your company bought or sold assets like vehicles, software, or equipment, you’ll need all related invoices, contracts, and payment proofs. These support your capital cost allowance (CCA) calculations, reported on Schedule 8 of the tax form.

Each asset is classified according to a tax category, with a specific depreciation rate. This makes it possible to spread the expense over several years, rather than deducting it all at once.

Note: Some assets (classes 44, 46, and 50) acquired after April 15, 2024, and placed in service before 2027 may qualify for an immediate deduction in the first year. Keep all supporting details to confirm eligibility.

Salaries, Dividends, and Shareholder Payments

Whenever your corporation pays salaries, dividends, or interest, you must issue the proper tax slips.

The T4 is used to declare salaries paid to employees, including executives. Even if you are the founder, you are considered an employee if you receive a salary. This type of remuneration gives you access to CPP and RRSP contributions, but also involves payroll and source deductions. T4 slips and summaries must be filed with the CRA no later than the last day of February following the calendar year (postponed to the next business day if necessary).

If you pay yourself dividends or interest instead, you must file a T5, also by the last day of February. Each dividend must be supported by a resolution and proof of payment. Dividends are declared and Part IV tax is calculated on Schedule 3; RDTOH (ERDTOH/NERDTOH) balances are paid from Part IV and may qualify for a dividend refund according to the applicable rules.

Each dividend must be supported by a board resolution and payment proof. Even if you’re the only shareholder, issuing proper slips ensures compliance and transparency.

Tax Credits and Deductions

Certain business expenses may qualify for tax credits or deductions. To benefit from them, always keep supporting documents.

Companies investing in research and development may be eligible for the SR&ED credit, with supporting Form T661. Charitable donations are also eligible for a credit, provided official receipts are attached to the return. Other programs, related to training or innovation, sometimes require attestations. And a fiscal year loss can often be carried forward to other years if you keep your financial statements.

Our advice is to keep everything, even if you doubt your eligibility. Your accountant can verify it for you.

Practical Scenarios: Inactive, Active, and Quebec Corporations

Every company is different. So the documents you need to provide for T2 may vary according to your situation.

Here are three typical cases to help you get your bearings.

1. Inactive Corporation

A Canadian-controlled private corporation (CCPC) is required to file a T2 corporate income tax return for each taxation year, even in the absence of taxable income or activity. This obligation applies to the majority of corporations resident in Canada, with the exception of a few special cases provided for by law.

At T2inc.ca, we offer a simple and affordable service for filing your T2 inactive return, entirely online and in compliance with CRA requirements. Our team asks only for essential documents, such as bank and credit card statements for the year, to confirm that no activity took place during the fiscal year.

We advise you to keep up to date with your tax obligations, even during periods of inactivity. This avoids unnecessary penalties and preserves your company's active status with the CRA. A well-filed T2 today always makes it easier to resume business tomorrow.

2. Active Small Business

An active business must submit a complete T2 business return, including financial statements, invoices, and, where applicable, T4 or T5 slips.

If your company invested in R&D or purchased assets, keep documents supporting your SR&ED and CCA claims.

A small business that keeps its corporate tax documents organized throughout the year will always file faster, with fewer errors and less stress.

3. Quebec Corporation

In Quebec, corporations must file both the federal T2 return (CRA) AND the provincial CO-17 return.

Both returns must report the same financial information, but the CO-17 requires extra items:

- A full PDF of your financial statements

- Proof for provincial tax credit claims

- Expense certifications, if applicable

By checking line 39 of the CO-17 form, you can also file your annual update with the Registraire des entreprises (RE-400) at the same time—saving time and avoiding duplicate paperwork.

Filing both returns together ensures consistency and reduces the risk of errors between federal and provincial levels.

Common Mistakes to Avoid

Even experienced business owners make mistakes when preparing their business tax returns. Here are the most common ones:

- Forget the T183CORP form: before any electronic transmission, the tax preparer must have the signed T183CORP form. Without this document, the T2 is considered unauthorized. The form must be kept for 6 years and must correspond exactly to the declaration filed.

- Entering the wrong NAICS code: failing to select the correct NAICS activity, or choosing an incorrect one, can lead to errors during preparation or transmission (EFILE/bar code). Choose the most accurate code before completing lines 284 to 289.

- Missing the deadline for T5 slips: T5 slips (dividends, interest) must be filed by the last day of February following the calendar year (postponed to the next working day if necessary). A simple oversight will result in penalties, even if the amounts are correct.

- Ignoring the electronic filing requirement: for tax years beginning after December 31, 2023, the T2 must be filed electronically for most companies (exceptions: certain insurance companies, non-resident companies, functional currency companies, tax-exempt companies under art. 149 ITA).

Simplify Your Corporate Tax Filing Process with T2inc.ca

Preparing your corporate tax documents is more than paperwork—it’s a strategy to save time, reduce risk, and uncover tax-saving opportunities.

When you organize your T2 documents early, you make the process smoother and give your accountant everything they need to file accurately.

At T2inc.ca, our mission is to make corporate tax filing simple and stress-free for Canadian entrepreneurs. Our online platform lets you upload your documents securely while our tax experts handle the review, preparation, and submission of your T2 return (and, if applicable, your CO-17 return for Quebec).

Request your free quote today and see how easy filing your corporate tax return can be with professional support and peace of mind.

- T2 Checklist: The Essentials

- Why Preparing Your Corporate Tax Documents Early Matters

- Essential Business Tax Documents to Gather

- Financial Statements: The Core of Your T2 Filing

- Supporting Corporate Tax Documents: Proof and Reconciliation

- Fixed Assets and Depreciation

- Salaries, Dividends, and Shareholder Payments

- Tax Credits and Deductions

- Practical Scenarios: Inactive, Active, and Quebec Corporations

- Common Mistakes to Avoid

- Simplify Your Corporate Tax Filing Process with T2inc.ca

Contact our experts

Have a question? Need help? Fill out our online form to get help from our experts.

Contact usNeed more help?

Contact us by filling out our form

Are you interested in our services, but would like more information before taking the plunge? Contact us today and one of our tax accountants will be in touch to help you.

At T2inc.ca, we're committed to helping business owners manage their company's tax affairs so they can grow their business.